LISA Financial simplifies your accounting

Integrated accounting module for your ERP system

User-friendly, fast, clear... these are just a few of the many assets of LISA Financial. When you integrate this financial module into your LISA ERP system, you can be sure of correct accounting and a clear understanding of the figures!

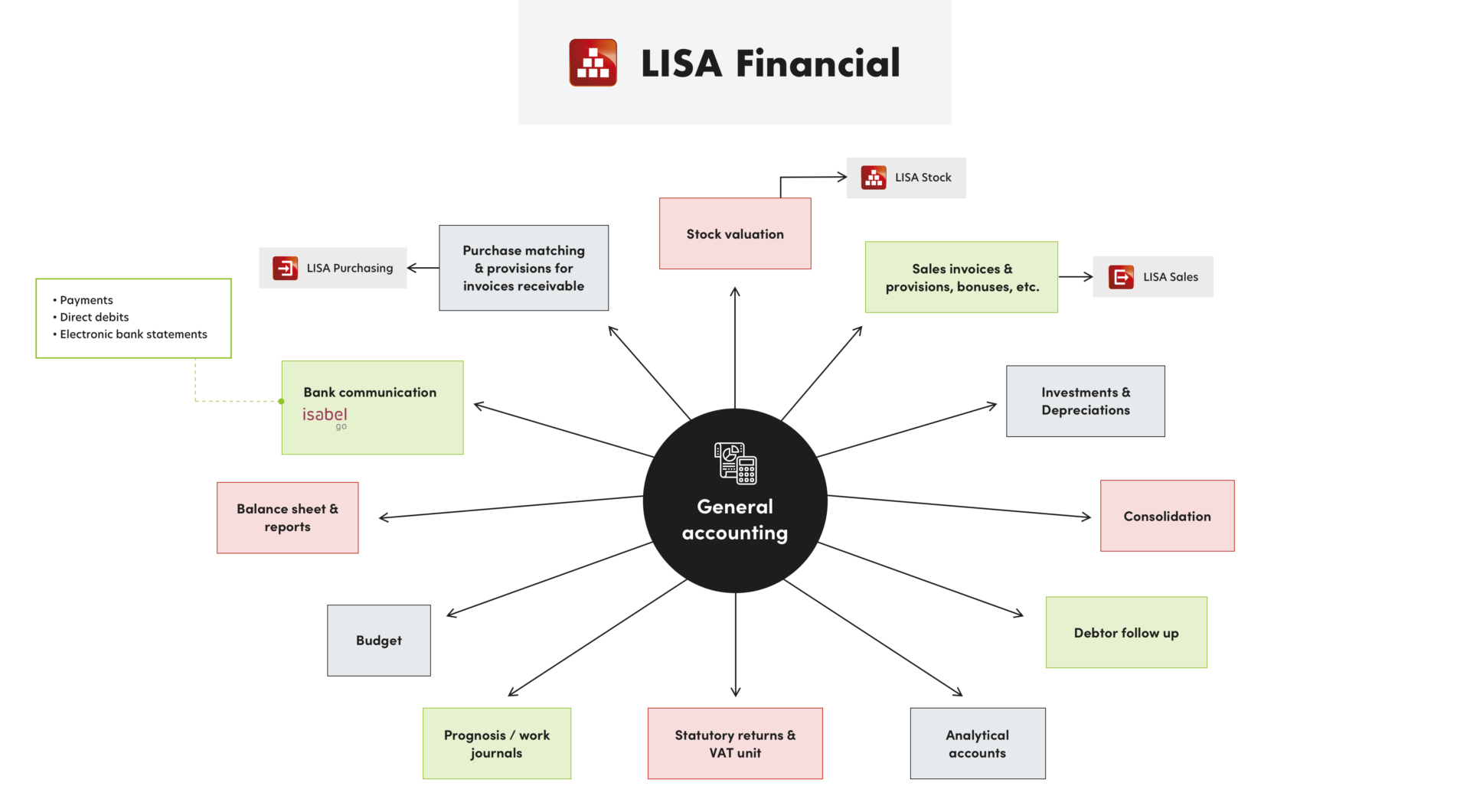

The possibilities in LISA Financial are endless. General accounting, automatic payments, a simplified approval flow, etc. Mix and match the functionalities and configure your own perfect financial module for your ERP system!

Advantages of LISA Financial

All-in-one:

Integration within LISA ERP makes automation possible

Windows-based:

The look & feel of Windows, with the same function keys

Versatile:

Different languages, files and users in one package

Legal framework:

VAT returns, year listings, tax forms, etc., calculate all periodic declarations easily

Co-working:

Common customers, suppliers, chart of accounts, etc., for inter-company & multi-company entries

100% modular:

Invest only in features useful for your business

LISA Financial began in '91 at the request of none other than Albert Frère. To date, this ERP system is still used in various Frère holding companies.

The key to transparent accounting

Of course, LISA Financial offers all the features you expect from a good accounting package. What makes LISA really unique? The possibility to define individual accounts.

You obtain an insight into the costs and revenues of certain items, such as vehicles, representatives, etc., or also loans and rent payments. Thanks to the ticking-off principle, you can convert general accounts into centralised accounts or individual accounts. This enables you to give a new dimension to your accounting!

Accounting module for your ERP system

Financial accounting

Customer and supplier management, the processing of purchase and sales invoices, processing bank statements (via CODA or CAMT), etc., this is the basis of the LISA accounting module. Everything runs extremely simply and super fast thanks to the multi-language, multi-file and multi-user nature of the accounting package.

LISA is ideally suited even for multi-company and inter-company entries. Add shared third parties, draw up a chart of accounts, make simultaneous entries, etc. – it all makes for an easy flow.

LISA Financial works in accordance with all legal requirements and has been certified for this by the National Bank and the Ministry of Finance.

Individual accounts

Define general accounts as individual accounts. In this way, LISA gives you a greater insight into the costs and revenues of certain items. Consider for example cars, representatives, loans, rent payments, etc.

LISA Financial allows you to define general accounts, such as the centralised accounts ‘customers and suppliers’. For example, you see the details of accounts 40xxx and 44xxx and can also tick them off. When a general account is defined as an individual account, it is also created as a centralised account with the individual account entered on it. However, if the general account is defined according to the ticking-off principle, you get exactly the same functionality as a conventional centralised account, such as the customer and supplier account.

Automatic payments

Thanks to this feature, payments to suppliers at home and abroad, but also to other creditors (such as taxes, personnel, prepayments) come into an automatic flow. The direct link with ISABEL enables you to start the payment process by a single mouse-click on the ‘ISABEL GO’ button.

A Miscellaneous Operation (MO) is generated automatically on the account ‘Payments in progress’ and an interbank file is created that goes directly to the bank via ISABEL. With a single mouse-click on the function key, you automatically post all supplier payments in the financial journal!

Pre-entry of journal purchases

Entering invoices is even faster thanks to this journal. Here, the purchase invoices are pre-registered, making them visible to anyone working with LISA. There is always plenty of time to check all the data, because the invoice is only entered after final approval. The invoice header is filled in automatically and, when linked with the DMS, the digital image of the invoice is also immediately visible. Isn't that convenient?

Simplified approval flow for purchase invoices

A new purchase invoice will be paid only after the approval of the person appointed. This person can be determined automatically based on the supplier, or you can also appoint someone manually. You can also assign several people for large amounts. They will receive an email with the digital version of the invoice in order to facilitate approval. You also have the option to perform an audit with the approval.

Collection via direct debit

Do you work a lot with direct debit? Then this module ensures that the process runs smoothly. You receive a proposal of the invoices to be collected, select them and send your assignment to ISABEL. On the account ‘Direct debit in progress’, a Miscellaneous Operation (MO) is generated and the system creates an interbank file that goes directly to your bank via ISABEL. Just one more click on the function key in your financial journal and all paid customer invoices are posted!

Financial journal via CODA

Do you dream of a streamlined accounting system? CODA brings you one step closer. These COded DAily statements (of your Belgian accounts) are arranged in a fixed structure, in accordance with Febelfin banking standards. You can upload these statements easily and quickly in LISA Financial for a semi-automatic entry in your financial journal. Here too, you have a direct link with ISABEL via ISABEL GO. The chance of errors decreases dramatically and your accounts are always up to date!

Debtor monitoring

With the accounting section, you can send automatic reminders by post or via email. The history of sent reminders is also tracked accurately. So it is very easy to consult the payment behaviour of each customer over any period!

Investments, projects and depreciation

Automation, an asset for the depreciation of your investments! After entering the purchase invoices, an investment sheet is created automatically. Here you will find the depreciation calculation, but also automatic entries and an analytical breakdown if necessary. This also includes the retirement of capital goods. Through tagging, you give each table, computer or chair a unique code indicating the location for a clear inventory of these assets.

The sub-modules tax depreciation (FIS) and economic depreciation (IAS/IFRS) give you a more accurate picture of the true economic value of your assets through automatic entries into the forecast and work journals. You are better off managing large investment projects via CAPEX (CAPital EXpenses). Budgets are accurately monitored and you book automatically from the general account ‘Active under construction’ to the final depreciation account.

Provisions & cost settlement over various periods

This module is a very useful addition if you are aiming for a correct economic distribution of costs over a certain period of time. This can range from a financial year to a longer period. With a provision, you ensure an equal distribution of the projected costs; through the netting, you adjust when the actual costs are known.

Analytical accounting

This analytical module goes one step further than the general accounts. You can make journal entries based on cost types and places and your chosen analytical dimensions. Moreover, you can select your own allocation formulas, whereby costs and revenues are distributed automatically over different analytical entries. In addition, you can easily determine which combinations can be used per general account. The option of working per Business Unit gives your analytical accounting a new dimension. Costs and revenues per BU can be collected in one accounting file. So you can easily compare the analytical results of different BUs.

Balance sheet management and reporting

The official financial statement in accordance with NBB is provided by default. If you want to define your own reports, you can create a template according to your wishes. Already calculated balances, whether or not in combination with forecast and work journals, are collected in an archive. This then serves as the basis for comparative reports. You can print them by sub-file or export them to Excel, PDF, etc., in different languages.

Internal consolidation module

With this module, you can bring together both the general accounts and the analytical and budgetary accounting of all your files in a new consolidation file. You can do this at cost type level, cost centre level, project level, work journal level, etc. Conversion is possible for files in a different chart of accounts or a different currency. A consolidation file provides the same capabilities as a conventional file in terms of entries and reporting.

VAT group

There can be different VAT numbers and declarations per company, which makes centralisation very simple.

Sub-files: multiple identities within a single legal entity

You can create different sub-files within one accounting file (one VAT number) to view the movement between the sub-files via general accounts. You can also easily draw up a reporting balance sheet or P/S balance sheet per (sub-) file. The periods set per sub-file ensure that they do not block each other. Finally, there is a built-in security that allows the user of a sub-file to work only in his defined sub-journals.